Transfer Pricing Obligations in Mexico - Fiscal Year 2019

I) OBLIGATION TO DOCUMENT (TRANSFER PRICING STUDY)

Article 76, sections IX and XII of the Income Tax Law (LISR for its initials in Spanish) establishes the obligation on behalf of the taxpayer to produce and retain documentation proving that its transactions involving revenues or deductions carried out with related parties were in compliance with the Arm’s Length principle1, as well as the legal requirements with respect to transfer pricing (TP study).

- Section IX: Related parties residing abroad.

- Section XII: Local related parties

a)Taxpayers subject to these obligations

Article 76 section IX paragraph II lists the taxpayers exempted from this obligation:

- Taxpayers with business activities whose revenues in the prior fiscal year did not exceed MX$13’000,000.00 pesos are exempt.

- Taxpayers whose revenues derived from the provision of professional services in the prior fiscal year did not exceed MX $3’000,000.00 pesos are exempt.

- Taxpayers that, despite not exceeding the aforementioned revenue thresholds, are presumed to carry out transactions with companies or entities subject to preferential fiscal regimes are not exempt. (Article 179, penultimate paragraph of the LISR).

Although Article 76 section IX paragraph II of the LISR establishes which taxpayers are exempt from the obligation to produce and retain a transfer pricing study, it does not completely excuse them from all obligations with respect to transfer pricing matters; in the event of an audit by the Tax Authority (TA), it will be necessary to prove that transactions carried out with related parties were in compliance with the Arm’s Length principle.

b) Related parties

Article 179 of the LISR, paragraphs V and VI, indicates that those taxpayers that are considered to be related parties are obligated to retain information regarding any intercompany transactions they may have carried out in order to ensure compliance with the Arm’s Length principle and facilitate audits by the TA.

c) Transfer pricing methods

Article 180 of the LISR lists the transfer pricing methods (approved by the OECD) for the determination of prices, amounts, or margins for considerations made between related parties in accordance with the Arm’s Length principle.

Section VI paragraph III of that Article establishes a hierarchical order to be followed in the application of the transfer pricing methods for the analysis of transactions among related parties...

d) Review faculty

The faculties of review with respect to transfer pricing matters are established in Article 46 section IV (transfer pricing review) of the Federal Tax Code (CFF for its initials in Spanish). If the taxpayer does not possess the transfer pricing study, it may be liable for infractions and fines for failure to meet this obligation.

II) SUBMISSION OF INFORMATIVE DECLARATIONS OR FISCAL DICTUM

a) Multiple Informative Declaration (DIM for its initials in Spanish) Appendix 9

In accordance with the stipulations of Article 76 section X of the LISR, those taxpayers that carried out transactions with related parties residing abroad must submit Appendix 9 of the DIM.

The deadline for the presentation of this obligation is March 31th, 2020.

b) Fiscal Status Information (ISSIF for its initials in Spanish)

In accordance with the established in the Article 32-H of the CFF, the taxpayers located in some of the following assumptions will be forced to present the ISSIF; the same that includes information about the diverse operations realized with related parts:

- Those who file under Title II of the Income Tax Law (LISR), who, in the prior fiscal year in which they filed taxes, reported income taxable under the Income Tax Law greater than or equal to an amount equivalent to MX $791’501,7602 pesos in their normal tax returns, as well as those that, as of the end of the prior fiscal year, had publicly traded shares held by investors in the stock market and do not meet any of the other descriptions listed in this article.

- Business partnerships that belong to the optional fiscal regime for groups of partnerships in terms of Chapter VI Title II of the Income Tax Law (LISR).

- Federally administrated para-state enterprises.

- Entities residing abroad that have permanent establishments in Mexico, only for the activities carried out by these establishments.

- Any taxpayer in Mexico, regarding to the operations carried out with residents abroad.

The TA does not require submission of the ISSIF from those taxpayers indicated by Section V of Article 32 of the CFF when the total amount of the transactions carried out with related parties residing abroad does not exceed MX $100’000,000 pesos3.

The deadline for the presentation of this obligation is March 31th, 2020 (together with the presentation of Annex 9 of the DIM).

c) Fiscal Report (Sipred, for its initials in Spanish)

In case the taxpayer chooses to present the Sipred in accordance with the arranged in the Article 32-A of the CFF; that is to say, those taxpayers which cumulative incomes during 2018 has exceeded $122’814,8304 or that the value of its assets is superior to $ 97’023,7205 or when at least 300 of its workpeople have given them its services in each of the months of the year consider; it will have to include in the annexes designated for this situation, information about the realized operations with related parties.

The taxpayers who perform this option, will assume the obligation to present ISSIF.

The Sipred and information referred to this rule have to be submitted no later than July 29th of the year immediately after the end of the fiscal year concerned, this if contributions are paid as of July 15th, 2020 and are reflected in the annex “List of payable contributions”. If this is not complied the fiscal report will be considered extemporaneous.

d) BEPS Informative Declarations

Article 76-A of the LISR stipulates that the taxpayers indicated in Article 32-H Sections I, II, III and IV of the CFF, must submit the following informative declarations regarding related parties no later than December 31 of the year immediately following the fiscal year in question:

- Article 76-A Section I. Master file on related parties in the multinational enterprise group. (Master File). This requirement does not apply to domestic enterprise groups that do not have related parties residing abroad.

- Article 76-A Section II. Informative declaration on local related parties (Local File). This requirement applies to all taxpayers indicated in Article 32-H Sections I, II, III and IV of the CFF that have related parties in Mexico and/or abroad.

- Article 76-A Section III. Country-by-country informative declaration (CbC or Country-by-Country). This declaration must only be submitted by taxpayers that fall into either of the following categories:

- Multinational controlling legal entities.

- Legal entities residing in Mexico or abroad with permanent establishments in Mexico that have been designated by the controlling legal entity of the multinational group residing abroad as responsible for providing the country-by-country declaration.

III) INFRACTIONS AND FINES

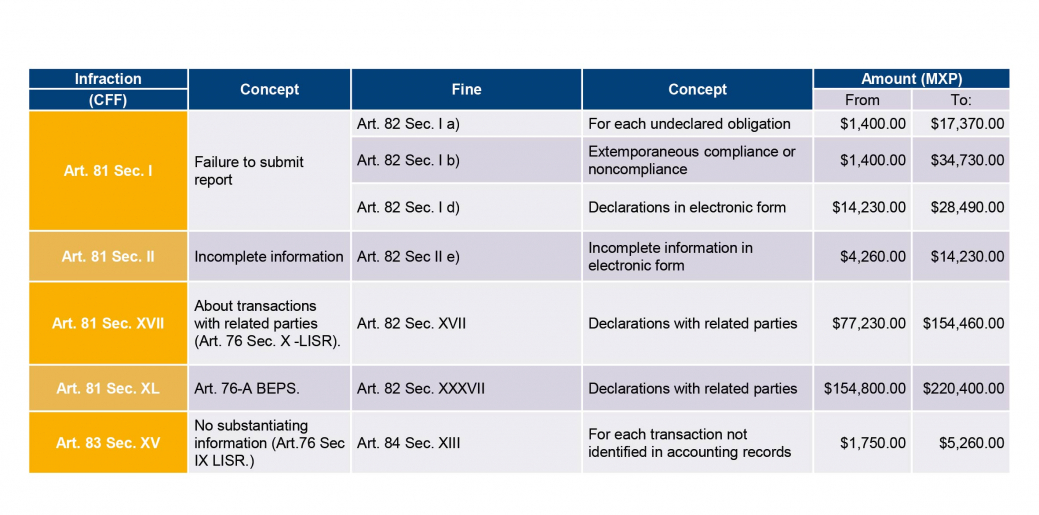

In the event that the TA determines that the taxpayer omitted information or failed to comply with their obligations with respect to transfer pricing in accordance with Mexican law, the latter will be liable for fines in accordance with the type of infraction committed. Some of the sanctions for non-compliance are listed in the table below:

Table 1

Transfer pricing: infractions and fines, FY 2019

Source: Our work based on information provided in the CFF (last information: 09-12-2019) and www.themis.com.mx

Consult the most up-to-date amount issued by the Tax Authority (SAT for its initials in Spanish).

1 The “Arm’s Length” principle is internationally accepted by the OECD and requires that intercompany prices be consistent with the prices agreed upon by independent companies in comparable transactions under similar circumstances, in such a way that the intercompany relationship has no effect on the determination of the prices.

2 Last modification DOF 09-12-2019.

3 Miscellaneous Fiscal Resolution (RMF for its initials in Spanish) for 2020, miscellaneous rule 2.19.3

4 Latest information available from CFF for 2020.

5 Idem.