The key points of the Mexican automotive industry

At the end of 2021, there was speculation that it would take the automotive sector in Mexico until 2023 or 2024 to regain speed after the complex panorama brought by the pandemic. Now, after a health emergency that put many industries in a tight spot, can we validate that forecast? How is 2024 going for the automotive sector?

Let's talk about 2023, a year in which results went beyond what was expected for the automotive industry in Mexico, as vehicle sales and production remained on the rise, with some factors favouring the industry.

For example, the united auto workers strike in the United States, which cost billions of dollars to the neighbouring country and affected the region, finally came to an end. Ford, General Motors and Stellantis resumed activities and the industry's economy reactivated by the end of the year.

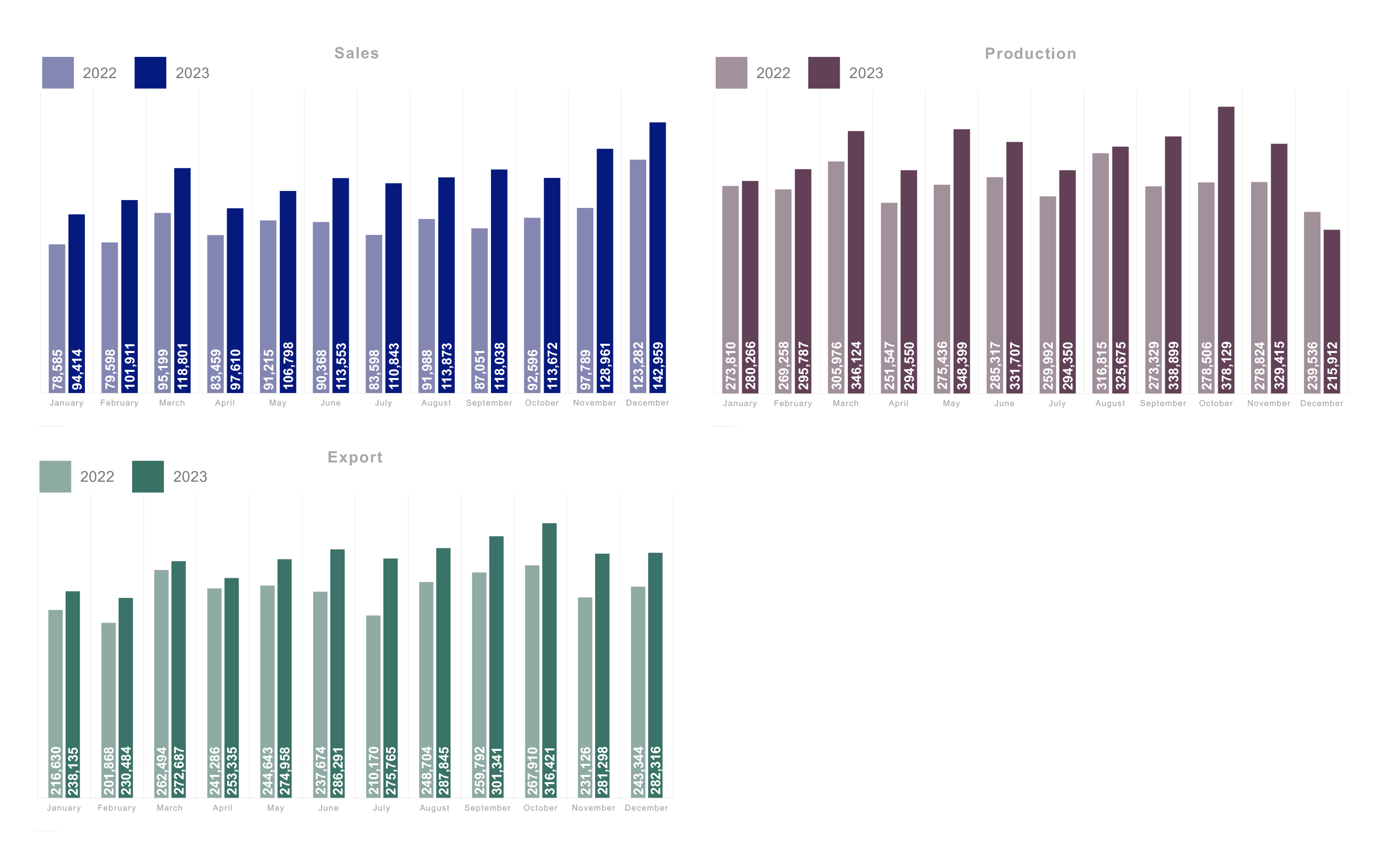

For its part, automotive production, export, and sale in Mexico increased throughout 2023, compared to 2022, according to the Administrative Registry of the Light Vehicle Automotive Industry of the National Institute of Statistics and Geography (INEGI). We can review the comparison, which continues to rise in January 2024:

How is 2024 going for the automotive sector?

In January of this year, there was an 18.7% (17,685) increase in units sold, compared to the same period in 2023, while in February, the increase compared to the same month last year was 11347 units (11.1%).

Some of the factors current and upcoming factors influencing this include:

- Reactivation of the industry in the United States. As we mentioned before, the end of the strike is beginning to have positive effects on the neighbouring nation, which are being replicated in its trading partners.

- Investment. A factor that will continue to be a driver of this industry, according to Armando Soto Armenta, president and CEO of KASO, an industry consultancy firm specializing in the analysis and creation of business solutions, who declared it during the 2023 Automotive Forum.

- Sales. An increase in sales in the sector was projected for 2023 and it materialized. Accumulated units sold amounted to 1,361,433 units in the year, or 24.3% more than the total sales in 2022. This trend is expected to continue rising, as evidenced by January 2024, which clearly surpassed sales, production, and exports in the first month of 2023 and 2022.

- Inventory growth. Another element that has improved significantly are the waiting times for the acquisition of vehicles, which have been reduced thanks to the growth of inventories. These are undoubtedly good news for customers in the industry.

These factors are cementing a positive 2024 for the automotive industry, although we must consider other issues that will be key for the sector to really be able to sustain this positive trend.

Key industry factors

Electric cars. Since 2021, hybrid, plug-in hybrid and electric vehicles have maintained a growth in sales that, while it may be described as moderate, has been constant. The Mexican Association of the Automotive Industry (AMIA) has reported rising sales, with Mexico City as the location where a little over 23% of the cars sold in the country are marketed. 2024 is set to be key in the consolidation of the electric and hybrid industry, which is increasingly present in Mexico. The manufacturers with the highest sales in this type are Toyota, Ford, Kia, and Nissan.

Election year. Elections, both in the United States and Mexico, can give a cause for speculation and hesitation among investors. However, the arrival of Asian brands such as Chirey, BAIC, JMC, BYD, MG, SEV, JAC, Changan, GWM and GAC Motor may be a driver of investment, thanks, again, to the transition to electric vehicles.

Nearshoring. In the past, companies sought to reduce costs by bringing factories to geographical areas where production was cheaper. However, now the trend is to bring production closer to geographic areas that are better located for trade purposes. For this reason, Mexico has become a strategic point in many industries, such as the automotive industry. This phenomenon, which outsources work activities to other countries located in strategic sites, has boosted foreign investment and 2024 is a key year for nearshoring.

At Mazars, we keep an eye on the prospects of the industry every day and into the future, to keep our high-level services at the forefront for the benefit of our customers, which allows us to provide them with proposals that add value to their business. If you are interested in learning more about these issues, contact us and a specialized team will advise you.

Source: Asociación Mexicana de la Industria Automotriz.

Source: Registro Administrativo de la Industria Automotriz de Vehículos Ligeros.

Want to know more?